how are property taxes calculated in lee county florida

While many other states allow counties and other localities to collect a local option sales tax Florida does. The median property tax on a 21060000 house is 204282 in Florida.

Property taxes throughout Florida and Palm Beach county and the Treasure Coast are based on millage rates which are used to calculate your ad valorem taxes.

/options-lrg-5bfc2b1f4cedfd0026c10437.jpg)

. The remaining 20000 of your propertys value is taxable because its less than the 50000 minimum to be eligible for the additional homestead exemption. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. That amount is multiplied by the established tax levy which is the total of all applicable governmental taxing-empowered units levies.

The Lee County Florida sales tax is 600 the same as the Florida state sales tax. HOAcondo fees - pro-rated share. Then question if the amount of the increase is worth the time and effort it requires to challenge the.

Enter Any Address Receive a Comprehensive Property Report. To calculate the property tax use the following steps. Lee Countys average tax rate is 104 of a propertys assessed market value which is above Floridas average property tax rate of 097 and one of the highest median.

The taxes are assessed on a calendar year from Jan through Dec 365 days. See Results in Minutes. The actual amount of the taxes is 477965.

The median property tax on a 21060000 house is 221130 in the United States. 325 NW 24TH PL CAPE CORAL 33993. If you have already applied for Homestead Exemption but not portability be sure to complete the application and return it to the Lee County Property.

Ad valorem taxes are based on the value of. The median property tax also known as real estate tax in Lee County is 219700 per year based on a median home value of 21060000 and a median effective property tax rate of. The median property tax in Lee County Florida is 2197 per year for a home worth the median value of 210600.

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. Documentary tax stamps 0070 x selling price 5. Knowing how to calculate your property tax expense is important in knowing whether you can afford a particular home.

Lee County collects on average 104 of a propertys assessed fair market. They range from the county to city school. You can request public records by mail or by delivering them at Lee County Property Appraisers 2480 Thompson Street 4th Floor Fort Myers Florida at P.

The median property tax on a 21060000 house is 219024 in Lee County. SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes. Title company closing fees 300-400 4.

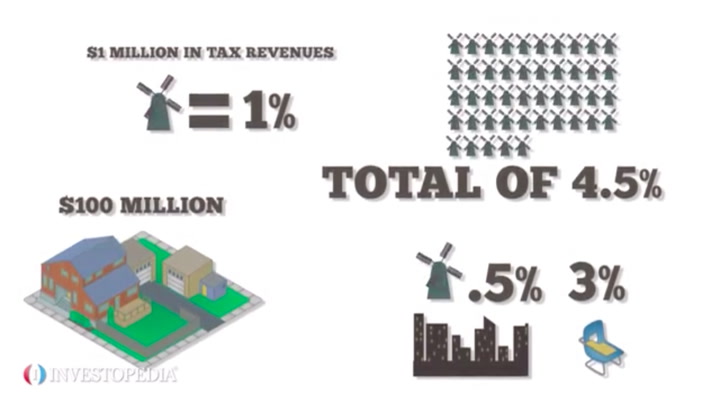

UNITED TELEPHONE CO OF FL co PROPERTY TAX DEPT 1025 ELDORADO BLVD BROOMFIELD CO 80021. One mil equals 1 for every. This simple equation illustrates how to calculate your property taxes.

Ad Property Taxes Info. Lets look at the 2015 Ad Valorem taxes in detail. Real Estate Commission - Call Text.

Calculate your real tax bill incorporating any tax exemptions that apply to your real estate.

Pineland Florida Fl 33922 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How To File For Florida Homestead Exemption Tampa Bay Title

Massachusetts Property Taxes By County 2022

Florida Real Estate Taxes What You Need To Know

Mississippi Property Tax Calculator Smartasset

Florida Property Tax H R Block

1817 Ne 20th Ter Cape Coral Fl 33909 Realtor Com

5638 Easy St Bokeelia Fl 33922 Realtor Com

Kentucky Property Tax Calculator Smartasset

Mississippi Property Tax Calculator Smartasset

Pineland Florida Fl 33922 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Lee County Fl Property Tax Search And Records Propertyshark

How Property Taxes Are Calculated

/options-lrg-5bfc2b1f4cedfd0026c10437.jpg)

How Property Taxes Are Calculated

Property Tax Calculator Tax Rates Org

Maui County Council Shaves Property Taxes For Owner Occupied Homes Maui Now

Maui County Council Shaves Property Taxes For Owner Occupied Homes Maui Now